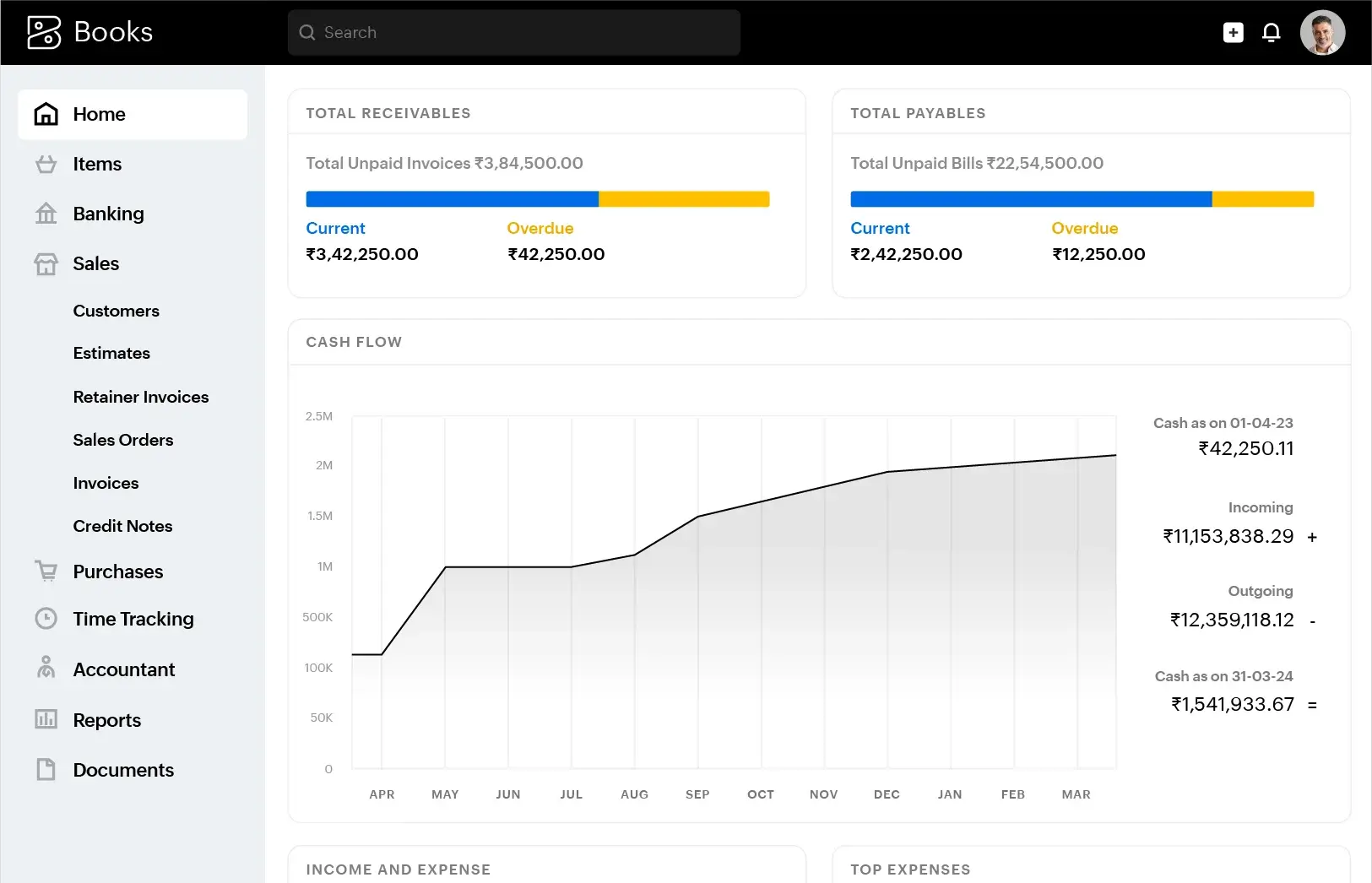

Comprehensive accounting platform for growing businesses

- GST compliance : Generate e-invoices, e-Way bills, and delivery challans. Calculate liabilities automatically, and file tax returns directly.

- Accounting Across Devices: Whether you’re on the web, smartphone or desktop app, promptly send quotes right after meetings, track business expenses, log time, and view reports!

- Connected banking: Simplify online payments. Fetch bank feeds, categorize entries automatically, and reconcile them effortlessly.

- Automation: Trigger emails or notifications for reminders or alerts. Set recurring actions, schedules, and field updates.

Key features,

- Customizable Invoices: Create personalized invoices with your branding, adding details like taxes, discounts, and payment terms.

- Recurring Invoices: Automate billing for regular services with recurring invoices, ensuring consistent and timely payments.

- Payment Tracking: Stay on top of your finances by tracking paid, unpaid, and overdue invoices, helping you maintain a smooth cash flow.

- Multi-Currency Support: Handle international transactions with ease by invoicing in multiple currencies.

- Integration with Payment Gateways: Accept payments through popular gateways like PayPal, Stripe, and more, directly from your invoices.

- Automated Reminders: Set up automated reminders for overdue invoices to improve collection efforts and reduce manual follow-ups.

Zoho Books simplifies invoicing, making it easy to manage finances efficiently, so you can focus on growing your business.

Key features,

- Record Expenses Quickly: Capture all types of expenses, including bills, receipts, and reimbursements, with ease. You can manually add them or scan receipts using the mobile app.

- Expense Categorization: Organize expenses into custom categories for better visibility and easier reporting.

- Recurring Expenses: Set up and automate regular expenses like subscriptions and rent, so you never miss a payment.

- Multi-Currency Support: Track expenses in different currencies for international businesses.

- Attach Receipts: Upload and store receipt images directly within the expense entries to keep everything organized.

- Expense Reports: Generate detailed reports that provide insights into your spending patterns, helping you make more informed decisions.

- Tax Compliance: Easily track tax amounts on expenses, ensuring you remain compliant with local tax laws.

With Zoho Books, managing business expenses becomes streamlined, helping businesses maintain control over their finances and optimize spending.

Key features,

- Real-Time Inventory Tracking: Monitor stock levels in real-time and get instant updates when items are purchased, sold, or returned.

- Product Categories: Organize your products into categories for easier tracking and reporting.

- Inventory Valuation: Track inventory value using different methods, such as FIFO (First In, First Out), to ensure accurate financial reporting.

- Multi-Location Support: Manage inventory across multiple warehouses or locations and streamline stock transfers.

- Stock Alerts: Set up alerts to notify you when stock levels are low, helping prevent stockouts.

- Custom Pricing: Offer customized pricing for products based on customer groups or sales types.

- Integrated Sales and Purchases: Seamlessly integrate inventory management with sales and purchase orders to automatically update stock levels as transactions occur.

- Purchase Orders and Stock Replenishment: Create and manage purchase orders to restock inventory when needed.

Key features,

- Automated GST Calculation: Zoho Books automatically calculates GST on sales and purchases based on the applicable tax rates, reducing the chances of errors.

- GST Invoices: Create GST-compliant invoices with the required tax details, such as GSTIN, tax rates, and amounts, ensuring conformity with regulations.

- GST Return Filing: Easily generate GST returns, including GSTR-1, GSTR-2, and GSTR-3B, and file them directly from Zoho Books, saving time and effort.

- Tax Reports: Generate detailed tax reports like GST summary, input tax credit (ITC), and tax paid reports to stay on top of your tax obligations.

- Tax Deducted at Source (TDS) and Tax Collected at Source (TCS): Zoho Books supports TDS and TCS management, helping you track tax deductions and collections.

- GST Filing Reminders: Get timely reminders for GST return filing deadlines to ensure you never miss a filing date.

- Multi-State GST: If your business operates in multiple states, Zoho Books supports managing state-wise GST calculations and reporting.

- Audit Trail: Maintain a clear and accurate audit trail of all GST-related transactions for easier reconciliation and tax audits.

Key features,

- Profit and Loss Report: Get a detailed overview of your income and expenses, helping you track your profitability over a specific period.

- Balance Sheet: Maintain a comprehensive record of your company's financial position, including assets, liabilities, and equity.

- Cash Flow Report: Monitor cash inflows and outflows to manage liquidity and ensure that your business has the necessary funds for day-to-day operations.

- Tax Summary Report: Get an overview of the taxes paid, including GST, TDS, and other applicable taxes, helping you stay compliant and prepared for audits.

- Customizable Reports: Create custom financial reports based on your specific business needs, adjusting for different periods, categories, and accounts.

- Multi-Currency Support: Generate financial reports in multiple currencies for international businesses, making it easy to consolidate global financial data.

- Financial Ratios: Calculate key financial ratios such as profitability, liquidity, and solvency to analyze the health of your business.

- Real-Time Reporting: Access real-time financial data, allowing for quick decision-making and a better understanding of your business’s financial standing.